Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

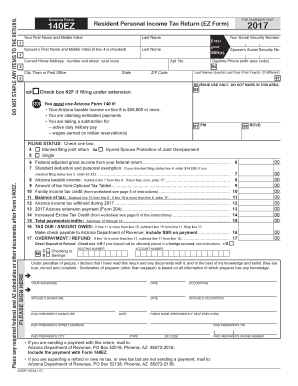

What is arizona form 140a?

Arizona Form 140A is a state tax form used by Arizona residents to claim their standard deduction when filing their state income taxes. It is a simplified version of Form 140, the full-length tax return form used by most Arizona taxpayers.

Who is required to file arizona form 140a?

Individuals who are required to file Arizona Form 140A are Arizona residents who are required to file an Arizona personal income tax return.

How to fill out arizona form 140a?

1. Download the form from the Arizona Department of Revenue website.

2. Complete the form by providing your name, address, and Social Security Number.

3. Enter the amount of Arizona income tax you owe on line 1.

4. Enter the amount of Arizona income tax you already paid on line 2.

5. Enter the amount of Arizona income tax you owe after subtracting the amount you already paid on line 3.

6. Enter the amount you are paying on line 4.

7. Sign and date the form.

8. Mail the form and your payment to the Arizona Department of Revenue.

What is the purpose of arizona form 140a?

Arizona Form 140A is a tax return form used by individuals who live in Arizona to report their income and calculate their Arizona state income tax liability. It is used for both residents and nonresidents of Arizona.

What information must be reported on arizona form 140a?

Arizona Form 140A is an individual income tax return form for Arizona residents. It requires taxpayers to report their income, deductions, and credits for the tax year. This includes wages, salaries, tips, interest, dividends, pensions, annuities, capital gains, rental income, unemployment compensation, Social Security benefits, and other income. Additionally, taxpayers must report any applicable deductions, such as student loan interest, charitable contributions, and alimony, as well as any applicable credits, such as the Arizona Charitable Tax Credit and the Arizona Education Tax Credit.

When is the deadline to file arizona form 140a in 2023?

The deadline to file Arizona Form 140A in 2023 is April 15, 2023.

What is the penalty for the late filing of arizona form 140a?

The penalty for late filing of Arizona Form 140A is generally 4.5% of the tax balance owed per month, up to a maximum of 25%. This penalty is applied for each month or part of a month that the return is late, starting from the original due date of the return. Additionally, interest is also assessed on any unpaid tax balance at a rate of 0.5% per month. It's important to note that these penalties and interest charges can vary, so it's recommended to refer to the Arizona Department of Revenue or consult a tax professional for the most accurate and up-to-date information.

Where do I find arizona form 140a 2012?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the arizona form 140a 2012 in seconds. Open it immediately and begin modifying it with powerful editing options.

How can I edit arizona form 140a 2012 on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing arizona form 140a 2012, you need to install and log in to the app.

How do I fill out arizona form 140a 2012 on an Android device?

On Android, use the pdfFiller mobile app to finish your arizona form 140a 2012. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.